What We'll Cover

- How to create a budget

- How to build an emergency fund

- How to prepare for a recession if you’re retiring or are retired

- How to prepare for a recession if you’re a student

Rising inflation, rising interest rates and a slowing housing market have Arizonans feeling uncertain about the future of the economy. Many are asking if a recession is on the way or whether we’re currently living through one – and if so, what they need to do to prepare.

While the idea of a recession can fill us with fear, it doesn't have to. Recessions are actually a common feature of the economic landscape. There have been 13 recessions since World War II, including three since 2001.

While no one can say for certain whether we’re heading for a recession, there are some simple steps everyone can take today to prepare for an economic downturn. Even if the economy stays healthy, these preparations will help you. They’ll give you a glimpse of your own financial health and allow you to make changes so that you can weather any financial storm.

What is a Recession?

A recession is defined by economists as two consecutive quarters of declining GDP (gross domestic product), which is simply a measure of economic growth.

Are We in a Recession Now?

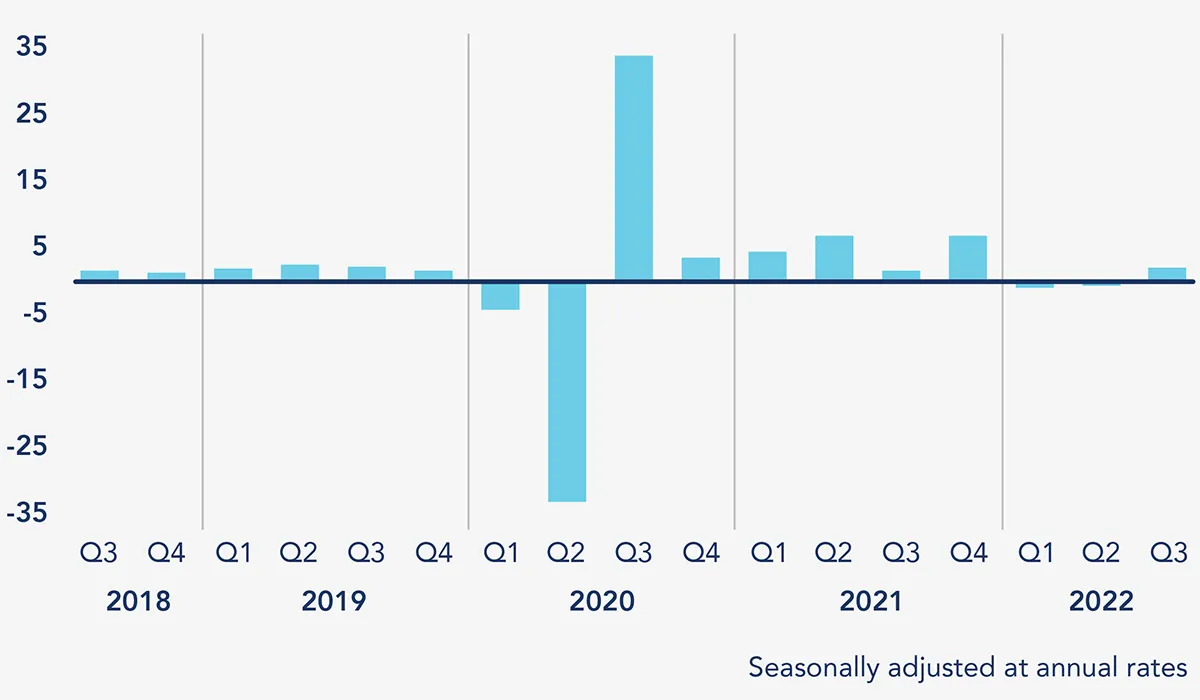

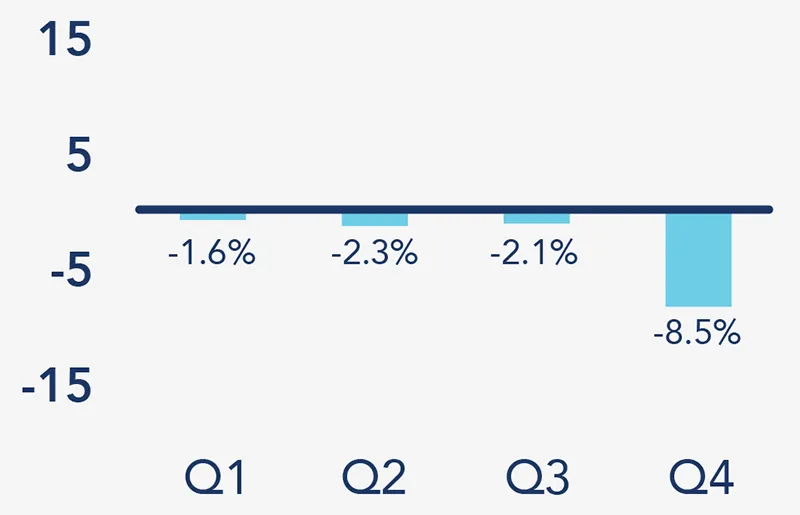

In 2022, the United States experienced two quarters with negative GDP, followed by a third of positive growth:

However, even with the historical definition, not all economists agreed that the United States was in a recession in 2022. They reference factors like continued job growth and other economic indicators pointing to a healthy economy. While the GDP numbers were negative for two quarters of 2022, they were only slightly negative when compared to the negative GDP during the 2008 year of the Great Recession.

5 Steps to Prepare for a Recession

Whether you're a college student, in the workforce, or retired, here are five things you can start doing to make certain you are recession-proof.

1. Create a Budget

Before you do anything, you need to take notice of exactly what is going on within your finances. The only real way to do this is to create a budget.

What is Your Take-Home Pay?

Start by adding up your take-home pay for any given month. This isn't how much you earn each month but rather how much actually hits your checking account that you can use for monthly expenses.

For those who get a paycheck every few weeks, this is going to be simple. However, if you're self-employed or you're not paid the same amount each month, then take an average of the past 90 days to obtain a monthly take-home pay you can work with.

Determine Monthly Expenses

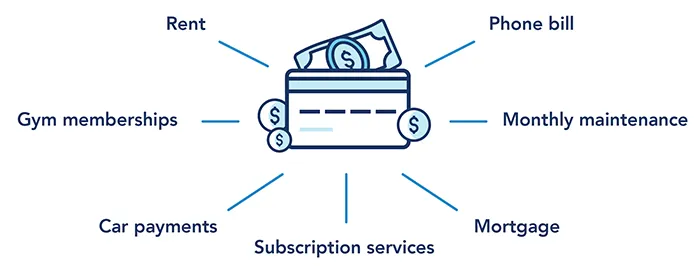

Next, you will need to look through all of your fixed monthly expenses. These will make up your monthly payments that remain the same each month:

Add up all of your monthly fixed expenses and subtract them from your monthly take-home pay. The amount leftover is how much you have to spend for all the other things you both need and want each month. This may include groceries, dining out, entertainment, department store purchases, gas for your car, and even travel expenses.

The key to a successful monthly budget is to plan out every dollar you will spend each month before the month actually begins. Instead of reaching the end of each month and wondering where all the money went, you are now telling every dollar where you want it to go before you actually spend it.

2. Reduce Your Expenses

After creating your monthly budget, you may realize that more money is going out than is coming in each month. If this happens, don't panic — you're more normal than you may realize.

A great way to learn how to prepare for a recession is to understand where your money is going and then reduce your expenses. Go back to that budget you created in Step 1. As you look over each of your expenses, start figuring out which expenditures you need each month and which you merely want.

Start cutting back on the "wants" first and if you still need to make some cutbacks, then look at the "needs" that may not be as necessary as you once thought.

3. Build an Emergency Fund

After you've created your monthly budget and have also reduced some of your expenses, you want to start building your emergency fund.

What is an Emergency Fund?

Think of an emergency fund as protecting you against Murphy’s Law – that old adage that says:

“Anything that can go wrong, will go wrong.”

Whether it's a broken hot water heater, a costly auto repair, or an unexpected medical bill — emergencies cost money. And the worst time to have an emergency is when you're broke!

An emergency fund is savings that will be used only for emergencies. This is not a savings account that has both emergency funds and vacation funds inside it – this is an account solely dedicated to money you’re saving to use when worse comes to worst.

The amount should be between three to six months' worth of expenses. To determine this amount, go back to your monthly budget and determine what absolutely must get paid for during a financial disaster. This about those essentials – food, rent, utilities, gas, insurance and medical expenses.

Next, take that monthly amount and then multiply by three to six months to get your fully funded emergency fund.

Having an emergency fund in place can be the difference between a small financial hiccup and a total financial disaster when Murphy's Law strikes.

4. Get Rid of Debt

The greatest tool you have during a recession is your income. However, monthly debt payments can add up quickly, robbing you of your income and leaving you in a tough position during a downturn in the economy.

List all your debts and then create a plan to pay off your debt as quickly as possible. Now, this could take some time depending on how much debt you have, but nevertheless, you must have a plan to pay down your debt.

One very popular method of getting rid of debt is using the debt snowball method. With the debt snowball, list out all of your debts from the smallest to largest balance and ignore the interest rates.

This could include high interest credit card debt or any other loans including auto loans, student loans or personal loans. One loan type you can omit from your debt snowball plan is a home mortgage loan.

After you've made your list of debts, make minimum payments on each of them and throw any and all extra money at your smallest debt. Once you have that smallest one paid off, cross it off your list and roll your debt payment into the next debt down on your list. Repeat this for each debt until the last one is paid off.

5. Keep Saving and Investing

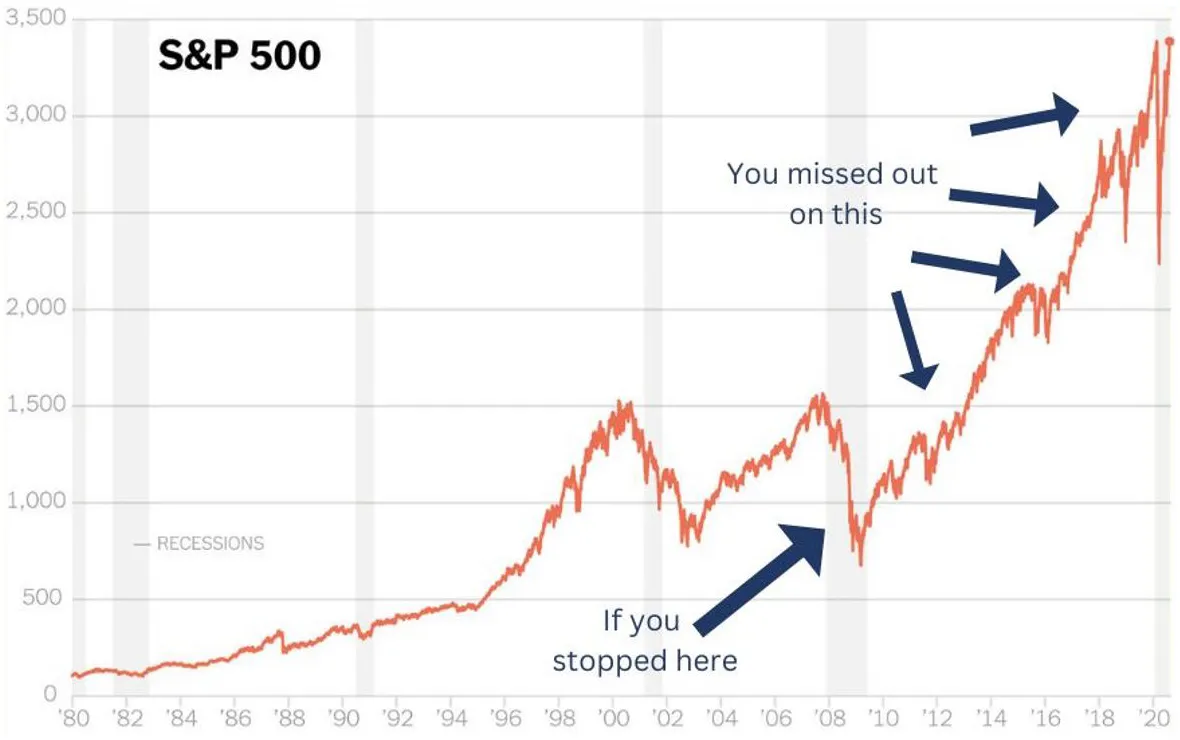

One of the biggest mistakes investors make is buying when the market is high and selling when the market is low.

Looking back at the Great Recession in 2008-2009, so many people lost faith in the economy and for good reason. They were losing their jobs, their homes, and many lives were completely destroyed.

The fallout from the Great Recession caused many investors to lose trust in the financial system and they stopped investing inside their 401k and IRAs and never started again.

Such dramatic action would’ve been a huge mistake.

As you can see, the stock market took a big dive during the Great Recession. However, just like we have continually seen with past recessions — eventually the markets always go back up with even higher returns than before the recession.

For those who decided to get out of the market and stay out of the market in 2008-2009, it was a huge mistake and a lot of missed opportunities.

Remember, whether we are in a recession or nearing a recession, the markets are down which also means there are some great discounts on stocks, mutual funds and ETFs. Instead of looking at this with a doom and gloom outlook, try looking at it from the perspective of investing at a discount.

How to Prepare if I am Retiring or Retired?

For those who are currently retired or retiring soon, you will definitely want to prepare for a recession with a little more caution. Retirees are usually on a fixed income, and if you're earning income from your investment assets, you may need to make some changes depending on where your assets are currently invested.

If you're invested in equities such as stocks, mutual funds, and ETFs, you may want to talk to your financial advisor about your risk tolerance versus your timeline. While history has taught us the markets have always rebounded after a recession, your timeline will look different than those who are planning to stay in the workforce for a while.

On the other hand, with interest rates going up, the savings rates on financial products have also gone up. It may be a great time to move into a low-risk savings product like a OneAZ Credit Union Share Certificate.

How to Prepare if I am a Student?

The good news about being a student during a recession is you have plenty of time to bounce back after a recession. However, it's still important to have a plan in place for if and when a recession comes along.

Create a plan for any income you may currently have using a monthly budget. This could be income you get from a job, from your parents, or income that you use from college savings.

Next, keep your expenses as low as possible while you're working through school. Do as much as you can to cash flow college expenses so you graduate on-time and with as little student loan debt as possible.

However, if you end up graduating with student loan debt, you may want to focus on paying of your student loan debt before looking to purchase a home , buy a new car, or make any other large financial decisions. In addition, there are four repayment plans available to help you lessen the burden of the monthly payment amount.

Frequently Asked Questions

What is inflation?

Inflation is when the price for goods and services go up. Another way to think about inflation is the value of your dollar goes down — the same amount of money you have today doesn't get you as much as the same amount of money one year ago.

Inflation in the United States is the highest it has been in nearly 40 years. To make things worse, if you live in Arizona, you're feeling the highest inflation in the country!

Inflation and recessions may be closely linked. Often, high inflation is a precursor to a recession. Not only is inflation felt by you and I, but businesses also feel the effects of inflation.

When it costs a business more money to provide the same product or service, the business is forced to decrease production. When this happens across the entire economy, we see a decrease in GDP, thus leading to a recession.

How long do recessions last?

Ironically, both the longest and shortest recession happened within the last 15 years. The longest recession was the Great Recession, which lasted 18 months. On the other hand, the shortest recession was in 2020 during the COVID-19 pandemic and lasted only two months.

Unfortunately, there is no way to actually know how long a recession will last. Many financial experts will have their ideas and opinions, but no one really knows the timeline for a recession in advance.

Are we currently in a recession?

If using the past definitions of a recession, then yes, we are currently in a recession after experiencing two consecutive quarters of negative GDP.

However, many economists are still not willing to declare we are currently in a recession and are basing their conclusions based on many other economic factors.

Where should I put my money in a recession?

This all depends on your current age, risk tolerance, and financial goals. One of the biggest mistakes investors made during the Great Recession is they pulled all of their money out of the stock market when the economy was down and stopped investing. Unfortunately, they missed out on the longest bull market in history, lasting 11 years!

If you're nearing retirement or you are currently retired, then the best place to put your money during a recession is into something with low volatility and low risk. You may want to consider a product like a share certificate.

Should I sell or buy a home during a recession?

When it comes to selling your home during a recession, you may want to consider all of your options. First ask yourself whether you need to sell or just want to sell your home.

Unfortunately, when the Federal Reserve increases interest rates, this results in fewer buyers shopping for homes. With fewer buyers and less demand, the value of your home will begin to level off and could even start to go down in value. Another option beyond selling your home is to go with a home equity line of credit (HELOC) if you need access to your home's equity.

As for buyers, keep in mind the Federal Reserve is raising interest rates in an effort to slow down or stop a recession from happening. Higher interest rates will lower the home loan amount you can get approved for as compared to when interest rates were lower. While you could always get approved for a loan now and then refinance when rates are lower, you're still going to purchase less than what you could have a year earlier.

Key Takeaways

- Your first step in preparing for a recession is to create a budget and know what is going on with your finances.

- If you're invested in equities such as stocks, mutual funds, and ETFs, you may want to talk to your financial advisor about your risk tolerance versus your timeline.

- Having an emergency fund in place can be the difference between a small financial hiccup and a total financial disaster during an economic recession.

When it comes to learning how to prepare for a recession, the bottom line is everyone should be creating a budget, boosting their emergency funds, and dumping as much debt as possible.

Remember, recessions are nothing new and unfortunately the next recession won't be the last.

Chris “Peach” Petrie is the founder of Money Peach. Money Peach partnered with OneAZ to provide free financial education to members across the state. To learn more about OneAZ’s partnership with Money Peach, click here.

APR = Annual Percentage Rate